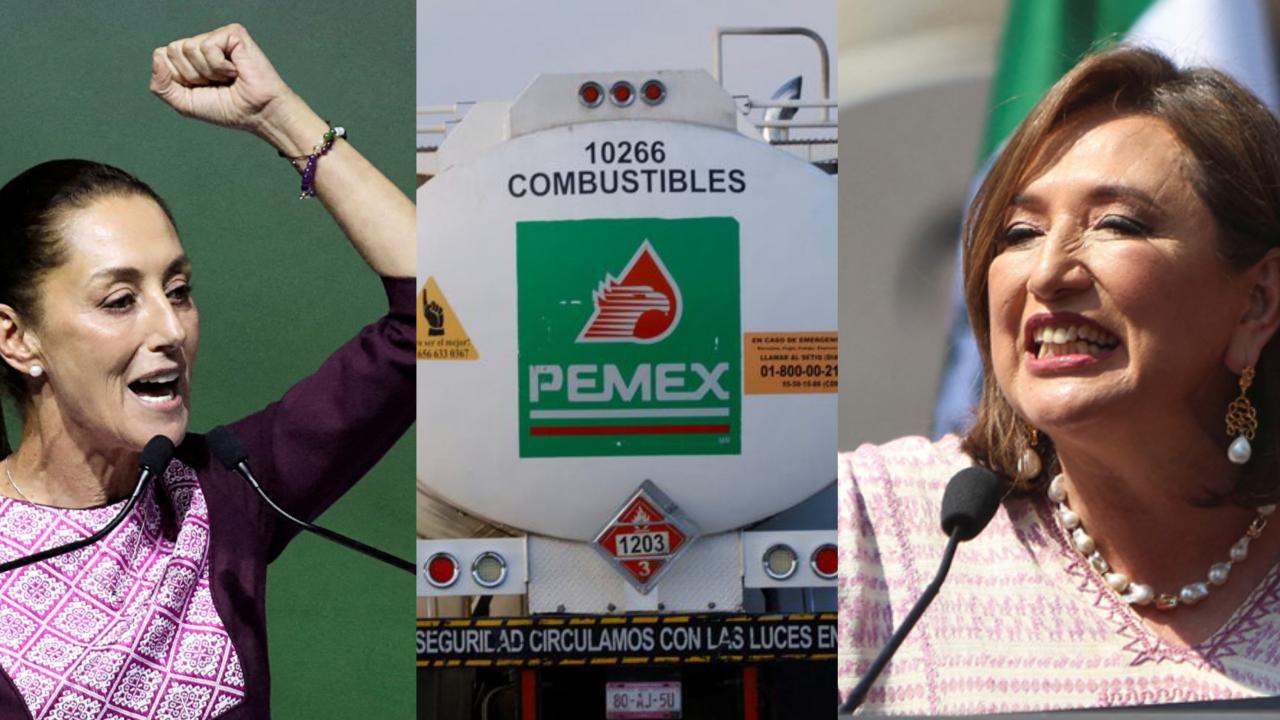

Two months before the June presidential elections, the candidates of the ruling party and the opposition agree on the need to introduce clean energy, but experts have doubts about the viability of the methods, as well as the future of Pemex and its multi-billion debt.

The dice have already been rolled and electoral polls reflect that Andrés Manuel López Obrador will be succeeded by the first female president of Mexico. According to the most recent survey by Diario Financiero, carried out in mid-March, Claudia Sheinbaum, candidate of the ruling Morena party, has 51% of vote intention.

This way, the former mayor of Mexico City maintains a comfortable 17-point advantage over her main opponent, Senator Xóchitl Gálvez, candidate for the opposition coalition Fuerza y Corazón por México. The first month of the campaign closed without any poll problems.

Meanwhile, other sectors of Mexico's public agenda show a turbulent outlook. For example, the energy industry is often accused of betting excessively on the exploitation of hydrocarbons, in detriment of renewable energies.

Although Sheinbaum, an environmental specialist, has promised to add sources such as lithium and green hydrogen to Pemex's portfolio, there are those who distrust her promises due to the negative balance that López Obrador's six-year term leaves for the state oil company: a large financial debt, as well as unfinished projects, such as the Dos Bocas refinery.

The polarization of the electoral campaign between Sheinbaum and Gálvez does not prevent coincidences, including the need to promote clean energy and expand electromobility services in large cities. It is in the implementation of these methods where differences and accusations of populism arise again.

For example, faithful to Morena's nationalist discourse, Sheinbaum has promised to guarantee Mexico's energy independence by reducing dependence on crude oil imports. This goal is so important for the ruling party that “Dialogues for Transformation”, Sheinbaum's technical team, has an energy sovereignty division. Its members trust that the oil acquisitions of López Obrador's six-year term will bear fruit in the long term.

“The infrastructure and development of the current government is fundamental for this goal. We can mention the modernization of the national refining system, the total purchase of the Deer Park refinery in Texas (USA) and the development of the Dos Bocas refinery. In that sense, we are seeing an increase in installed capacity to reduce dependence on energy,” says Tonatiuh Martínez, economist and energy specialist on the Morena team.

Although in January, López Obrador promised that by February 28, the Dos Bocas refinery, located in the State of Tabasco, would operate at 100%, the promise was not fulfilled. However, faith in the project remains: Martínez maintains that when Dos Bocas reaches its maximum capacity, dependence on oil imports will be reduced by 5 to 6%.

However, Mexico depends more on foreign crude oil than it appears. Héctor Villarreal, economist and research professor at Tecnológico de Monterrey, points out that the Aztec country imports approximately 60% of the oil it consumes. The analyst points out that Pemex's refineries are too old to be truly competitive, although there are exceptions such as Deer Park, acquired by Pemex from British oil company Shell in 2022.

“In reality, it is not easy to stop importing fuels and we do not necessarily want to do it. The irony is that Mexico loses a lot with its local infrastructure, because the government embarked on the adventure of building a giant refinery like Dos Bocas, which still does not fully operate and when it does, it will continue to lose money," Villarreal warned. AmericaEconomy .

From the other side, Rosanety Barrios, energy analyst on Xóchitl Gálvez's team, agrees that the Deer Park model should be ideal for Pemex's future investments. “It is a refinery that operates with profits and respect for the environment. We could never think that Deer Park would operate in the terrible conditions of Mexican territory. And the incredible thing is that we are talking about a refinery that has the same capacity as Dos Bocas, but that cost an eighth of what the latter has cost so far,” Barrio noted for AméricaEconomía .

Regarding the other refineries in Mexico, the opposition team specialist emphasizes that the lack of investment in maintenance has been key in the increase in pollution and loss of crude oil value. To begin with, Barrios points out that the six Pemex refineries have lost almost 800,000 million pesos (US$ 48.08 billion) in five years, because the crude oil is very heavy and they lack the necessary equipment to process it.

“So, every time a barrel of our oil enters the refineries, a third is spoiled and converted into fuel. Our refineries are very old. To this fuel problem, we must add that this administration, far from strengthening them, has practically abandoned them. To the point that now the refineries are burning sulfur, a highly polluting element that does a lot of harm to people,” Barrios laments. According to the economist, this liability occurs in the six refineries, but it is so serious in the Tampico and Caderey facilities that they warrant their closure and reconversion in said cases.

Faced with an indebted present and a future where oil will give way to clean energy, economist Héctor Villarreal leans towards the construction of modular refineries. These are oil facilities that are built in sections or modules so that they can be easily transported and relocated. “They are small and efficient, you can scale their production. Building them implies thinking about a great demand for oil, but that it will eventually last one or two more decades,” he says.

On the other hand, Ramsés Pech, energy analyst and associate professor at the National Autonomous University of Mexico (UNAM), is even less optimistic about the rhetoric of AMLO and his possible successor. From their perspective, energy sovereignty is an unrealistic term, because all countries must import some type of energy or technology for its transformation and subsequent use in gross domestic productivity activities.

“In addition, we must remember that Mexico has energy self-sufficiency by having sufficient primary energies (nature resources), but lacks self-sufficiency to transform this for use, because we do not create or have our own technologies,” declared Pech in an interview with AméricaEconomía .

THE INHERITANCE OF DEBT

Pemex's million-dollar debt, which amounted to US$106 billion by March 2024, is another key protagonists of the electoral discussion around the energy sector. From the official side, the intentions to continue with the delivery of state funds to Pemex to avoid bankruptcy are not hidden.

“Contrary to what the opposition has tried to say, Pemex is not a burden to the national treasury. During this six-year term, Pemex has contributed on average 11% of the country's budget income. Likewise, the oil company has given the government 3.7 trillion pesos (US$ 222.35 billion) and in response, it was granted 1.5 trillion (US$ 90.14 billion). More than half of these funds have been used to pay and service their debt,” said Héctor Romero, an economist member of Claudia Sheinbaum's team, for AméricaEconomía .

On the other hand, for Ramsés Pech, Pemex's accumulation of losses should not be underestimated. “Pemex's debt, being part of the public debt, will influence the long term, because it is not reducing the capital, but is only refinancing it, extending maturities, therefore, interest payments raise higher. Much of this debt is being accumulated after 2030,” he warns.

To reverse the deficit trend, Rosanety Barrios proposes to diversify Pemex's income. “If we want the company to start exploring, as it should, someone else has to give the government the oil revenues, which today Pemex no longer gives us. And we must be patient to obtain them, because first they must be explored,” declares the economist.

Under that premise, Barrios announces that Xóchitl Gálvez's team proposes a return to oil rounds so that other companies explore new deposits at a greater speed. This way, Pemex discovers the oil that can still be sold in a profitable way. “This does not mean disappearing the six refineries, although it does mean reducing this activity that the government has historically lost to the private sector due to lack of investment,” Barrios proposes.